The Economic and Retirement Prospects of Women Over Fifty

Recent national poll finds more than one-third of Lady Boomers are just meeting basic needs and are experiencing a crisis in confidence about retirement income

Data from the survey identified one potential factor for these financial disparities. Kids. Fifty-five percent (55%) of Lady Boomers report having made a significant change in their careers, 27% of whom to devote time to their children and families. And this devotion extended well into their adulthood. “Of those who have adult children, 49% say they continued some level of support for their adult children, many of whom boomeranged home when life outside the nest, with its pesky responsibilities, thwarted their efforts at independence”, said Vantage Data House pollster, Liz Kitchens.

This extended financial aid to adult children may have also contributed to the crisis in confidence among 35% of this age/gender cohort who are not at all confident they will have sufficient income to see them through their retirement years. This anxiety is stronger among women with less education, those whose household income is $50,000 or less, and among African American women. (Figure 2.)

Forty-three percent are currently employed full time while 30% say they are completely retired. Half (49%) of 61–70-year-olds are working full time, part time or are self-employed, and 22% of 71–80-year-olds are still working full time, part time or are self-employed. “Traditional notions about retirement are changing from the concept of a complete stop at a prescribed age to working past retirement age for financial reasons or even social/intellectual reasons,” said Kitchens, who specializes in research related to aging issues and the author of Be Brave. Lose the Beige: Finding Your Sass After Sixty.

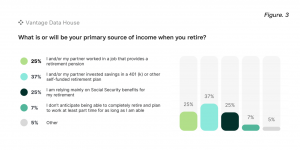

Thirty-seven percent anticipate relying exclusively on Social Security benefits in their retirement years or don’t envision being able to retire until it becomes necessary. “With Trump/Musk-led Department of Government Efficiency (DOGE) attacks on the Social Security Administration, there are probably some scared oldsters out there,” Kitchens speculated.

*Seven hundred and twenty women over the age of 50 were interviewed in a demographically representative sample by Vantage Data House, a bi-partisan public opinion research firm. The margin of error for this survey is 3.7%

Liz Kitchens

Be Brave. Lose the Beige!

+1 407-310-7613

Liz@bebravelosethebeige.com

Visit us on social media:

LinkedIn

Instagram

Facebook

Distribution channels: Banking, Finance & Investment Industry, Consumer Goods, Culture, Society & Lifestyle, Politics, U.S. Politics

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release