Lubbock County Commercial Property Could be Overvalued

O'Connor discusses how Lubbock County commercial property could be overvalued in 2025.

LUBBOCK, TX, UNITED STATES, June 9, 2025 /EINPresswire.com/ --

Lubbock County is in many ways a window into how Texas used to be. Rather than a trendy suburb of Houston, Austin or Dallas, Lubbock and the surrounding area keep the down-to-earth values seen in rural and small urban areas of Texas. This is even true for property taxes, as they have stayed within the realm of reality, instead of shooting to the moon like many big cities. Property values are still malleable and the machinations of the Lubbock Central Appraisal District (CAD) can be hard to get a handle of.

Lubbock Homes Grow 1.9% in Taxable Value

Like most counties in Texas, Lubbock County’s biggest reservoir of property value is in single-family homes. Sitting at $23.27 billion in 2025, the assessed value of all residences grew by 2.9%. Homes worth under $250,000 and those worth between $250,000 and $500,000 make up most of the value, at $9.80 billion and $8.63 billion respectively. While these middle-class homes added only 1.9% and 2.2% in value respectively, this translated into the most value gained in real money terms. The biggest rise in percentage was properties worth more than $1.5 million, which saw an uptick of 12.1%.

When single-family homes are examined by size, it is clear that they follow the same pattern as above. The vast majority of value is concentrated in homes under 2,000 square feet and those between 2,000 and 3,999 square feet. These modest homes combined for over $21 billion in value. While many Texas counties see larger homes with a lion’s share of the value, Lubbock remains steadfast as a community for working and middle-class families. The three size backets above these homes did see a higher growth by percentage, with mammoth homes over 8,000 square feet adding the most at 10.1%.

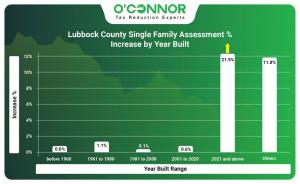

The value of homes by age of construction sees an even split among different eras for the most part. The three oldest subsets are within a few percentage points of one another. Even new construction is within this scope, albeit a little lower at 13% of all value. The only outlier is for homes constructed between 2001 and 2020, which accounts for a whopping 35% of all home value. As one would expect, most of the increase in value was seen with newer construction, which added 21.9% to its value.

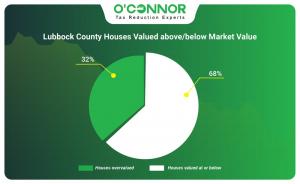

There have been efforts to improve Lubbock CAD in recent years, and these seem to have born fruit in 2025. While still not ideal, it was revealed that about 32% of Lubbock residences were overvalued. This can seem quite high, until you realize that 52% of homes were overvalued in 2024. This is a strong improvement and hopefully means that the taxpayers of Lubbock County will receive better treatment. This number is still high; however, and taxpayers should explore property tax protests to ensure they are always paying their fair share.

Lubbock CAD Undershooting the Market?

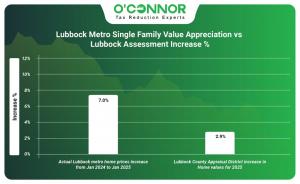

Inverse to Lubbock CAD’s previous history of overvaluing homes, some outside research is showing that they are actually aiming considerably lower than the housing market. A study by the Lubbock Association of Realtors (LAR) collected information on home sales within the county. They found that homes were selling at 7% higher in 2025 than they were in 2024. Compared to Lubbock CAD’s number of 2.3%, LAR shows stronger appreciation in homes. This could be a correction from previous stints of overvaluation, or it could mean that Lubbock County is seeing real growth in its housing market.

Lubbock Businesses Add 3.6%

While it was smaller homes that dominated when it comes to residential value, the opposite is true for commercial properties. $2.88 billion of the total $6.43 billion commercial value is from businesses worth over $1.5 million. Big businesses owned triple the value of small businesses worth under $500,000 and even managed to grow 5.8%. Commercial properties as a whole were valued at 3.6% higher. Businesses worth less than $500,000 were the only ones to see their value reduced in 2025.

When broken down into types, we can see how the 3.6% was added to commercial value. No one business type really ran away with things, and all grew within a few percentiles of the rest. Hotels were the only commercial properties to show no growth. Apartments commanded the biggest share of property value as a whole, a typical arrangement for a Texas county. Land edged out offices for second place, with both being worth over $1 billion.

It seems that the story of Lubbock’s growth as a county can be illustrated entirely through graphs. Commercial property follows the exact pattern of residential properties when it comes to value and age. There is a noticeable spike in the years between 2001-2020, where 40% of the current value was created. There is a dead even split of 15% for properties constructed from 1981-2000 and 1961-1980. New construction added 22% more value in 2025 and now accounts for 5% of all value.

Another reason to question the numbers of Lubbock CAD is an analysis conducted by the firm Green Street Real Estate. According to them, the valued of commercial property across the United States declined by 21% since its record high in 2022. This puts the 3.6% growth rate from Lubbock CAD in a new light. Either Lubbock County property is still overvalued, or perhaps the county is doing better than the national average. It would take a deeper dive to decide which of these scenarios is true, though both could be correct to some extent.

Apartments Still No. 1

Apartments and other multi-family homes managed to stay as the top source of commercial property value in Lubbock County, though they did not see universal growth across construction ages. Older apartment buildings saw their appraised values fall, with 12.1% being knocked off the value of buildings constructed before 1960, while those built between 1961 and 1980 lost 2.1%. As with residential and other commercial properties, the majority of total value came from construction between 2001-2020. New construction did not see much growth, with only a .3% jump.

Lubbock CAD does not break down apartments into a litany of subtypes like other appraisal districts do. Instead, they simply differentiate between garden apartments and the rest. Garden apartments accounted for $2.16 billion in value, opposed to $40.88 million generated by generic apartments. Garden apartments also added 3.9% to their value, while generic jumped 15.7%.

Offices Stand Strong and Gain 4.5%

Offices came in behind apartments and raw land for the third-place spot but made some progress to close the gap on land. Worth an assessed total of $1.30 billion, offices added 4.5% to their value. Like other forms of construction, the biggest block of office value was built in the boom period of 2001 to 2020, with 37% of all value. All older construction accounts for less as the age they were built increases. Paradoxically, the two biggest risers by percentage were the oldest construction and the newest buildings. Those built before 1960 grew by 11.1%, while those built in 2021 or after notched a respectable 15.7%.

Like apartments, Lubbock CAD only uses two subtypes for offices. $960.72 million in value is assessed to regular offices, while $342. 92 million is given to medical offices. Medical and generic offices added 3% and 5% to the assessed value respectively.

Shopping Centers Drive Retail

When we examine Lubbock County’s retail property by age, we get no surprises. The same pattern is observed, with construction between 2001-2020 getting the biggest share of value at 40%. There was a massive jump in the value of new construction. However, retail property built from 2021 onwards saw a meteoric jump of 187% in 2025. This brought recent construction from $22.85 million to $65.66 million.

Retail properties grew from $848.53 million in 2024 to $879.79 million in 2025, a rate of 3.7%. Retail stores added $40 million in value, jumping up 12.4%. Neighborhood shopping centers were top dogs in 2024 and continued to reign into 2025 with a total of $335.84 million. The only retail type to lose taxable value was community shopping centers, which dropped 6.7%.

Lubbock Warehouses Remain Stalwart

Warehouses are the fourth-biggest contributor to Lubbock County’s assessed commercial value, totaling $270.14 million. Warehouses nabbed an assessed growth of 5.4% in 2025, which indicates solid growth. Like everything else built in the county, the majority of present value was built between 2001 and 2020, making up 44% of the total. New construction is responsible for 10% of all value but only added 1.1% in 2025.

Lubbock CAD is again spare on details when it comes to warehouse types that they classify. Breaking down only in general warehouses and mini warehouses, there is not much detail to pour over. Unlike a lot of Texas, mini warehouses actually made up the bulk of value and growth, with $165.23 million and 6.8% respectively.

Lubbock in Conclusion

When looking at these graphs, it is clear to see that Lubbock County, while growing, is mostly a community for the working and middle-class. In a time of skyrocketing home prices, this makes Lubbock County a sanctuary for the average person. When compared to unsustainable value increases like Travis County or the suburbs around the DFW Metroplex, the county has shown steady growth in most aspects.

While outside studies have shown that home values across Lubbock County could be undervalued by the CAD, there is still plenty of room for homeowners to explore with property tax appeals. This goes double for commercial owners, as there is some evidence of overvaluing property by Lubbock CAD in that regard. The history of inaccuracy, no matter the direction, by Lubbock CAD also shows how things can change from year to year. This illustrates why it is important to protest your taxes annually, so you can catch any discrepancies.

Appealing your taxes can feel like a full-time job, especially if you need to do formal appeals or even go for a lawsuit. O’Connor is here to help. Founded in Texas over 50 years ago, O’Connor is dedicated purely to protecting the property rights of residents across the United States, with a focus on Texas, Illinois, Georgia, and New York. O’Connor will protest your taxes automatically every year, and you will only pay from your savings if you win. As your taxes can never go up in the appeal process, you have nothing to lose and everything to gain.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Distribution channels: Banking, Finance & Investment Industry, Building & Construction Industry, Business & Economy, Consumer Goods, Real Estate & Property Management

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release