Klasszis: The Best Hungarian Investment Funds and Fund Managers, Innovations Announced

Privátbankár.hu has once again presented the Klasszis 2025 awards to the top professionals in the domestic fund management industry.

BUDAPEST, HUNGARY, April 17, 2025 /EINPresswire.com/ -- Klasszis: The Best Hungarian Investment Funds and Fund Managers, Innovations AnnouncedThe assets of Hungarian investment funds continued to grow dynamically in 2024, approaching 18 trillion forints, representing a 27.7% increase. Privátbankár.hu has once again presented the Klasszis 2025 awards to the top professionals in the domestic fund management industry. The Fund Manager of the Year is HOLD Asset Management, Portfolio Manager of the Year is Gábor Szőcs, and Emerging Portfolio Manager of the Year is Ágnes Czakó.

Explosive Growth in Funds

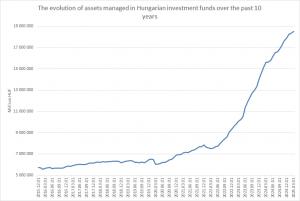

At the end of December last year, members of the Association of Hungarian Investment Fund and Asset Management Companies (Bamosz) managed 17.89 trillion forints in investment funds, not including assets held in pension funds, insurance, and other portfolios. This represented a 27.7% jump, with the chart showing almost exponential growth. Notably, in the previous year, 2023, there was a 50.8% leap, and the results of previous years were also consistently positive.

The role of investment funds in Hungarian savings is becoming increasingly important; according to Bamosz data, their capital has continued to grow over recent years and decades, despite new crises and market turbulences. According to MNB statistics, a large portion of this vast wealth is typically held by households. This enormous amount of capital gives the sector significant macroeconomic importance and highlights the need for professional evaluation and recognition of funds and their managers. Privátbankár.hu has presented these awards for the twelfth consecutive year, this time at a ceremonial event on April 15.

Awards for the Best

In 2024, the Fund Manager of the Year is HOLD Asset Management, and Portfolio Manager of the Year is Gábor Szőcs (HOLD Asset Management). The Emerging Portfolio Manager of the Year title went to Ágnes Czakó (OTP Fund Management), based on the combined results of professional and public voting. In this latter category, the competition was among nominees under 40 years old. These three awards were given based on votes from both the industry and the general public.

Who Won the Most Awards?

Based on objective calculations of returns and risk, awards were given in 16 additional fund categories to specific investment funds, usually for first, second, and third places. OTP Fund Management achieved 11 podium finishes, HOLD Asset Management nine, MBH Asset Management seven, and Accorde and Erste fund managers six each in 2025. The full list of winning funds can be found on Klasszis.hu.

Over twelve years, more than 650 awards and podium places have been distributed among fund managers, with OTP, Hold, and Erste fund managers receiving the most over the years. However, even the smallest companies have achieved success in certain categories, making it difficult to find a fund manager that has never won.

The Privátbankár.hu Klasszis award serves as a distinguishing mark that can help investors select the best products from the extremely wide range of investment funds. This is especially important for investors who do not have the time or expertise to analyze the entire market.

Comparing Based on Returns and Risk

When objectively evaluating fund performance, considering only returns is not enough, as the level of risk taken to achieve those results also matters. Privátbankár.hu has therefore developed complex indicators that take both returns and risk (return volatility) into account, based on methodology accepted and recognized by the industry. Further details, rules, and the list of winners are available at Klasszis.hu.

Innovative Solutions Also Awarded

For the first time this year, Innovation of the Year awards were also presented, recognizing financial innovations that primarily serve investors and, secondarily, the financial and asset management profession and the development of the domestic capital market. In addition to Bamosz-member fund managers, private banking providers, premium service financial institutions, and investment service providers could also apply. Winners were announced in four categories:

• Best Investment Product Innovation: K&H Regular ETF Investment Program – K&H Securities

• Shiwaforce – Best Digital Innovation: 100% Digitally Accessible Wealth Management Service – Concorde Securities

• Best Communication Innovation: Web Communication-Education Project – Amundi Asset Management

• Best Private Banking Innovation: MBH Holistic Wealth Management Service – MBH Bank Private Banking

Andras Gaspar

Privatbankar.hu

gaspar.andras@privatbankar.hu

Visit us on social media:

LinkedIn

Distribution channels: Banking, Finance & Investment Industry, Companies, Insurance Industry, Real Estate & Property Management

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release