Ellis County Commercial Property Values Skyrocket in 2025

O'Connor discusses the high increase for Ellis County commercial property values in 2025.

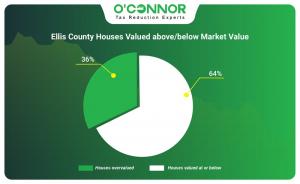

DALLAS, TX, UNITED STATES, June 5, 2025 /EINPresswire.com/ -- Ellis Appraisal District (ECAD) has released proposed noticed values for property tax assessments in 2025. During the 2025 property tax reassessment in Ellis County, around 36% of homes were overvalued, while 64% were assessed at or below market value. Despite the majority of homes being valued fairly or conservatively, many residential property owners are still struggling with high property taxes. Property values across the county rose significantly, with residential properties increasing by 7.9% and commercial properties by 19.6%.

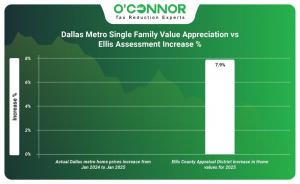

Ellis County Residential Values Increase by 7.9%

An analysis of property tax assessments by value range in Ellis County shows a steady and positive trend. Overall, every category by value range increased, especially for luxury homes. The lowest market value growth was seen in houses valued less than $250k with 6.4%. The highest increase was seen in houses valued at more than $1.5 million by 14.7%, rising from $1.3 billion to $2 billion. Other luxury homes also experienced high value increases, such as homes valued between $1 million to $1.5 million with 10.2%, a 2025 notice market value of $1.1 billion.

Similarly to value range, in Ellis County, property values per square foot increased with home size, with larger homes experiencing significant value growth. A clear trend shows that the higher the home’s value, the greater the increase in assessment. Homes measured at less than 2,000 square feet saw a low increase of 6.5%. Compared to those, residences over 8,000 square feet jumped 10.5%. Homes between 6,000 and 7,999 square feet also saw a high jump of 11.7%.

According to ECAD, all homes increased in assessment value, without regard for the year they were constructed. However, there was no clear trend due to the age of a property. The greatest increase in value was seen in newer homes built after 2021 with 29.7%, growing from $4.5 billion to $6 billion. The lowest increase in value was seen in properties built between 2001 and 2020 with 1.8%.

36% of Homeowners Face Unfair Market Values

In 2025, ECAD overvalued 36% of homes in the county, based on a comparison between reassessed property values and actual home sale prices from 2024. Meanwhile, 64% of homes were assessed at or below their market value. Although this trend indicates some progress—fewer homes are being overvalued compared to previous years—it remains a concern for many homeowners. Inaccurate or inequitable assessments continue to drive high property tax bills, leaving residents frustrated and financially strained despite broader improvements in valuation accuracy.

According to research by the MetroTex Association of Realtors, the reality of property values and sales do not meet the lofty values put forward by ECAD. While ECAD claimed that property values are up 7.9%, MetroTex found that home prices in the Metroplex were actually only up by .3%. This wide gulf between what ECAD claims and what home sales show is certainly ripe for property tax appeals and could show a hidden problem in Ellis County.

Commercial Property Skyrocketed by 19.6% in Value for 2025

An analysis of commercial property tax assessments in Ellis County by value range reveals a clear upward trend: the higher the property value, the larger the assessment increase. Lower-value commercial properties saw minimal growth or slight declines, while higher-value properties experienced substantial increases. For example, properties valued at $500,000 or less had a modest 7.1% increase in assessed value. In stark contrast, properties valued over $5 million saw a dramatic 27.0% increase, with total assessed value rising from $3 billion to $4 billion.

For the 2025 tax year, ECAD raised the market values across all categories of commercial properties. The largest increases were seen in hotels with 36.5% and warehouses with 29.3%. Office property also greatly increased by 26.2% and retail increased by 24.0%.

Commercial property assessments for 2025 by the ECAD increased across all construction years, especially in older property. Surprisingly, newer properties built between 2001 and 2020 only increased by 15.6% compared to other categories. Older properties, such as those built before 1960, saw a high value increase of 29.1%. The highest increase was seen in commercial properties built in 2021 and later with 46.6%, growing from $847 million to $1.2 billion.

When Property Values Do Not Match the Market

The 2025 commercial property tax reassessment by ECAD stands in sharp contrast to findings from Wall Street firm Green Street Real Estate Advisors. While Green Street reports a 21% decline in commercial property values nationwide since their peak in 2022, the ECAD claims these values have increased by more than 19.6% over the past year.

Apartments Increased Greatly in Value for 2025

This graph reveals an inconsistent correlation between the year an apartment was built and the percentage increase in its 2025 property tax assessment in Ellis County. However, despite the inconsistency, apartment property owners experienced high value increases overall for 2025. Apartments constructed in 2021 or later experienced the highest increase at 45.3%. Following closely behind are apartments built before 1960 with an increase of 30.1%, rising from $18 million to $23 million. In contrast, those built between 2001 and 2020 saw a small rise of 5.5% with a market value of $723 million for 2025.

In 2025, apartment owners in Ellis County were hit with a substantial property tax increase, as the appraisal district raised the overall taxable value of apartment buildings by 20.5%.

Modern Office Buildings Increased to Greatest in 2025

According to ECAD, property tax assessments for office buildings in 2025 have increased across all construction years, especially newer buildings. The highest increase, 64.3%, affects office buildings built in 2021 or later, rising from $75 million to $123 million. Meanwhile, buildings built between 1981 and 2000 saw a slight increase of 13.7%. The overall increase in assessment value for 2025 was 26.2%, growing from $458 million to $579 million.

In 2025, only one office property subtype—general office buildings—was assessed in Ellis County. Property tax assessments for these buildings rose by 26.2% compared to the previous year.

Retail Property Increased in Value by 24% in 2025

Property tax assessments for retail buildings in Ellis County rose across every construction date. Retail properties built in 2021 and later increased the highest in value by 58.3%, growing from $47 million to $74 million. Older retail buildings also saw high increases, such as those built between 1961 and 1980 with 24.6%.

Property tax assessments increased for two retail property subtypes in Ellis County for 2025. Out of the two, single-tenant retail buildings saw the higher increase at 24.8%, while strip shopping centers saw the lower increase of 22.7%.

Warehouse Tax Assessments Increased by a High of 29.3%

All warehouse building owners in Ellis County saw high property tax increases for 2025. Warehouses built before 1960 saw the highest value increase by 40.2%, followed by warehouses built in 2021 and later with 36.8%. Another notable value increase was seen in warehouse properties built between 1961 and 1980 with 30.9% and a 2025 notice market value of $196 million.

ECAD evaluated two subtypes of warehouse properties—mini warehouses and standard warehouses—for the 2025 tax year. Mini warehouses saw the larger increase in assessed market value, rising by 44.3%, while standard warehouses increased by 25.2%. Overall, the total market value for warehouse properties in the county grew from $1 billion in 2024 to $1.3 billion in 2025.

Summary for Ellis County 2025 Property Tax Revaluation

In 2025, property owners in Ellis County are experiencing significant increases in their property tax assessments, especially for commercial properties. While residential property values rose by an average of 7.9%, based on factors such as value range, square footage, and year built, commercial property assessments saw a much steeper average increase of 19.6% across similar criteria. Although some homeowners have seen relief from previously inflated valuations, approximately 36% of residential properties are still considered overvalued, leaving many owners concerned about rising tax burdens in the county.

Appeal Assessment Values Every Year

Property owners in Texas, including those in Ellis County, have the right to appeal their property tax assessments. Whether the property is residential or commercial, the appeals process provides an opportunity to challenge valuations that may be excessive by presenting supporting evidence. Filing an appeal—or partnering with a property tax consulting agency—can be highly beneficial, as the majority of protests result in reduced assessments. For over 50 years, O’Connor has been helping property owners lower their tax liabilities through cost-effective and proven strategies, ensuring clients pay a fair and accurate amount.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Distribution channels: Banking, Finance & Investment Industry, Building & Construction Industry, Business & Economy, Consumer Goods, Real Estate & Property Management

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release