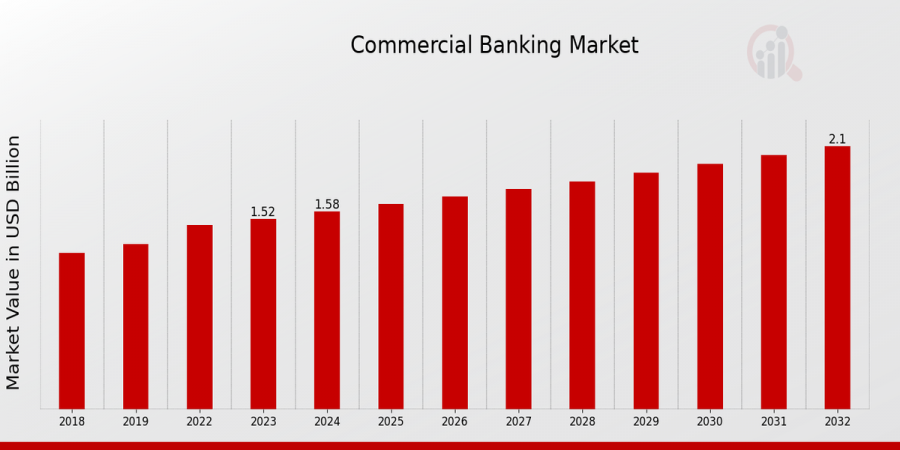

Commercial Banking Market Size Reach $2.1 Billion by 2032

Commercial Banking Market Research Report By, Banking Services, Banking Products, Industry Verticals, Bank Models, Regional

HI, UNITED STATES, April 17, 2025 /EINPresswire.com/ -- The Commercial Banking Market continues to play a pivotal role in global financial systems, supporting businesses of all sizes with essential banking services and capital access. In 2022, the market was valued at USD 1.47 billion and is projected to grow from USD 1.52 billion in 2023 to USD 2.1 billion by 2032. This reflects a compound annual growth rate (CAGR) of 3.64% during the forecast period (2024–2032). The market growth is driven by digital transformation in banking services, increasing global trade activities, and the rising demand for credit and financing among small and medium-sized enterprises (SMEs).

Key Drivers of Market Growth

Rising Demand for SME Financing

Commercial banks are increasingly offering tailored financial products and credit facilities to small and medium-sized enterprises, which are crucial contributors to economic growth in both developed and emerging markets.

Digital Transformation and Fintech Integration

The rapid adoption of digital banking platforms, mobile apps, and AI-powered financial services has significantly enhanced customer experience, operational efficiency, and service scalability in the commercial banking sector.

Globalization and Trade Expansion

The expansion of global trade networks has increased the demand for cross-border transaction services, trade finance, and foreign exchange solutions provided by commercial banks.

Increased Investment in Infrastructure and Commercial Projects

Governments and private entities across the globe are investing heavily in infrastructure, real estate, and industrial development, fueling demand for commercial banking services such as project financing and syndicated loans.

Regulatory Evolution and Compliance Modernization

Revised banking regulations and compliance frameworks have led to improved risk management, transparency, and operational resilience within the commercial banking industry.

Growth in Cash Management and Treasury Services

Businesses increasingly rely on commercial banks for sophisticated treasury solutions, including liquidity management, payment processing, and risk hedging services.

Download Sample Pages – https://www.marketresearchfuture.com/sample_request/40604

Key Companies in the Commercial Banking Market Include:

• Credit Agricole

• Royal Bank of Canada

• State Street Corporation

• HSBC Holdings

• JP Morgan Chase

• Wells Fargo

• Bank of America

• BNP Paribas

• Santander

• Citigroup

• UBS

• Standard Chartered

• Deutsche Bank

• Barclays

• Morgan Stanley

• Goldman Sachs

Browse In-Depth Market Research Report – https://www.marketresearchfuture.com/reports/commercial-banking-market-40604

Market Segmentation

To provide a comprehensive view, the Commercial Banking Market is segmented based on service type, end-user, and region.

1. By Service Type

• Loans and Credit Facilities

• Trade Finance

• Treasury and Cash Management

• Deposit Services

• Merchant Banking Services

• Foreign Exchange Services

2. By End-User

• Small and Medium Enterprises (SMEs)

• Large Enterprises

• Government & Public Sector

• Non-Profit Organizations

3. By Region

• North America: Dominates due to strong banking infrastructure and high corporate banking penetration.

• Europe: Sustained growth driven by SME financing and digital banking adoption.

• Asia-Pacific: Fastest-growing market with rising business activity in emerging economies.

• Rest of the World (RoW): Moderate growth led by expanding financial inclusion initiatives.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=40604

The global Commercial Banking Market is set for steady growth, bolstered by technological innovation, increased capital requirements, and the evolving financial needs of businesses worldwide. As banks continue to modernize their offerings and expand into underserved markets, commercial banking will remain a critical driver of economic development and financial inclusion.

Related Report –

Electric Vehicle Insurance Market

Motor Insurance Market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release