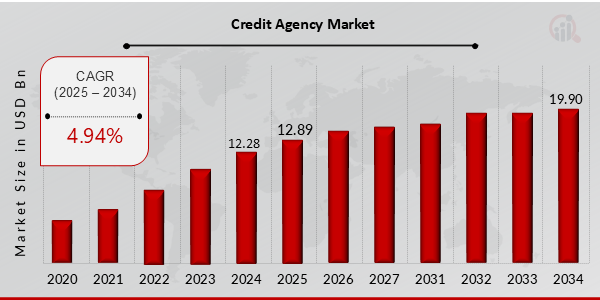

Credit Agency Market Size Forecasted to Grow at 4.94% CAGR, Reaching USD 19.90 Billion by 2032

Credit Agency Market Growth

Credit Agency Market Research Report By, Credit Rating Type, Scale, Services Offered, End User, Regional

TX, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- The global Credit Agency Market has experienced steady growth in recent years and is set to expand further in the coming decade. In 2024, the market size was estimated at USD 12.28 billion and is projected to grow from USD 12.89 billion in 2025 to an impressive USD 19.90 billion by 2034, showcasing a compound annual growth rate (CAGR) of 4.94% during the forecast period (2025–2034). This growth is primarily fueled by increasing demand for credit analysis, expanding financial markets, and heightened emphasis on risk management.

Key Drivers Of Market Growth

Growing Financial Markets and Globalization

The expansion of global financial markets and the rising need for comprehensive credit risk evaluation have boosted the demand for credit agency services. Businesses and individuals rely on these agencies to assess creditworthiness and manage financial risks effectively.

Increased Emphasis on Risk Management

In an era of economic uncertainty, organizations are prioritizing robust risk management strategies. Credit agencies play a crucial role in offering insights and analytics that mitigate credit-related risks, driving their adoption across industries.

Rising Demand for Credit Monitoring Services

With the increasing prevalence of personal and corporate credit usage, there is a growing need for credit monitoring services. Credit agencies are capitalizing on this trend by providing real-time insights and customized solutions.

Technological Advancements in Credit Analytics

The integration of artificial intelligence (AI) and big data analytics has transformed the credit agency industry. These technologies enable more accurate credit assessments, predictive modeling, and enhanced decision-making processes, further propelling market growth.

Download Sample Pages: https://www.marketresearchfuture.com/sample_request/24072

Key Companies In The Credit Agency Market

• Moody's

• China Chengxin International Credit Rating

• S Global Ratings

• CARE Ratings

• Acuité Ratings Research

• DBRS Morningstar

• Fitch Ratings

• Rating and Investment Information

• Dagong Global Credit Rating

• Brickwork Ratings

• China Lianhe Credit Rating

• ICRA Lanka

• Japan Credit Rating Agency

• CRISIL

• ICRA Limited

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/credit-agency-market-24072

Market Segmentation

To provide a comprehensive analysis, the Credit Agency Market is segmented based on service type, end-user, application, and region.

1. By Service Type

• Credit Scoring Services: Providing scores for individual and corporate creditworthiness.

• Credit Reporting Services: Generating detailed reports on credit history and financial behavior.

• Risk Management Solutions: Offering tools for assessing and managing credit risks.

2. By End-User

• Banks and Financial Institutions: Utilizing services for loan approvals and credit risk assessment.

• Corporates: Relying on credit agencies for financial insights and supplier evaluations.

• Individuals: Increasing demand for personal credit scores and monitoring services.

3. By Application

• Personal Credit Analysis: Monitoring and managing individual credit health.

• Business Credit Analysis: Supporting corporate decision-making and financial planning.

• Investment Risk Assessment: Providing critical insights for investment strategies.

4. By Region

• North America: A mature market driven by advanced credit systems and regulatory frameworks.

• Europe: Growth fueled by stringent credit assessment standards and expanding financial services.

• Asia-Pacific: The fastest-growing region, supported by rapid industrialization and increasing credit adoption in emerging economies like China and India.

• Rest of the World (RoW): Moderate growth expected in Latin America, the Middle East, and Africa due to improving financial infrastructure.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24072

The global Credit Agency Market is on a path of consistent growth, driven by technological innovation, expanding financial ecosystems, and heightened awareness of credit management's importance. As individuals and organizations prioritize informed decision-making and risk mitigation, credit agencies are poised to play a critical role in shaping the future of financial stability and growth worldwide.

Related Report:

Consumer Electronics Extended Warranty Market

https://www.marketresearchfuture.com/reports/consumer-electronics-extended-warranty-market-31367

Insurance Platform Market

https://www.marketresearchfuture.com/reports/insurance-platform-market-31358

Refinancing Market

https://www.marketresearchfuture.com/reports/refinancing-market-31329

Livestock Insurance Market

https://www.marketresearchfuture.com/reports/livestock-insurance-market-33395

Factory and Warehouse Insurance Market

https://www.marketresearchfuture.com/reports/factory-warehouse-insurance-market-33057

About Market Research Future

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release